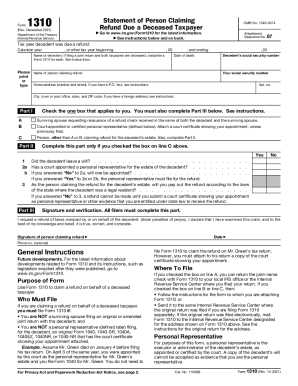

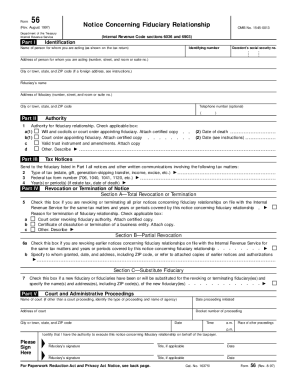

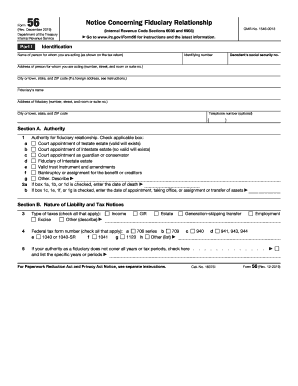

IRS 56 2022-2024 free printable template

Get, Create, Make and Sign

How to edit irs form 56 online

IRS 56 Form Versions

How to fill out irs form 56 2022-2024

How to fill out IRS form 56:

Gather all necessary information and documents:

Begin by completing the Identification section:

Fill out the Estate or Trust Information section:

Complete the Fiduciary Information section:

Provide details about the Suspended or Terminated Fiduciary:

Answer the questions under the Selection of Action section:

Sign and date the form:

Who needs IRS form 56:

Video instructions and help with filling out and completing irs form 56

Instructions and Help about irs form 56 online

Okay for this video I wanted to cover the IRS form 56 which is titled notice concerning fiduciary relationship, so this form can be filed in a number of different circumstances uh but in this video I wanted to cover frankly was one of the more common ones where you have an individual that is now deceased, and they're either their sibling or their children or another individual is responsible for serving as the executor of their state, and they're again ultimately responsible for filing final tax returns the final 1040 or also a form 1041 if there is a trust that is left over so in this fact pattern what we have here is we have john q taxpayer he is the deceased individual and then the individual that is the fiduciary for his estate is going to be Jane d smith which is his daughter okay, so we'll just go through the form here what are some key elements and sections you need to complete and um given this fact pattern what pieces can you perhaps leave blank so uh top of the form here john q taxpayer this is the person for whom you're acting...

Fill 56 irs : Try Risk Free

People Also Ask about irs form 56

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your irs form 56 2022-2024 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.